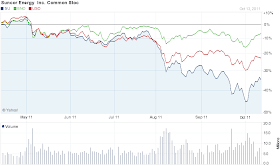

STOCK MARKET....Bob said: "The S&P 500, already in October -- one day remaining, is up 13.6% for the month...It's the biggest monthly gain in 37 years. You have to go back to 1974 to find a monthly gain comparable. It has been an awesome stock market rally."

(BOB'S) ECONOMIC REPORTS FROM LAST WEEK

DURABLE GOODS ORDERS = Not including transportation, up 1.7% for September.NEW HOME SALES = 5.7% -- A bounce in new home sales. (Honey EC: This is after four straight months of declines and a home-builders cut in prices.)

GROSS DOMESTIC PRODUCT...Bob said: "We mentioned last weekend, I thought you could see a GDP number of 2 1/2%, and we got that...in the third quarter....That was almost double the second quarter of 1.3% annual rate."

INFLATION...Bob said: "The Federal Reserves' favorite core inflation gauge, up only 1/10 of 1% year-over-year, it's only ahead 1.6%"

Honey EC: Bob is

referring to the Personal Expenditure Price Index which excludes both

food and energy. The headline number rose 0.2% in September and has

increased 2.9% over the past twelve months.

RECESSION OR NO RECESSION? Bob said: "The stock market was not waiting for any of this news to come out (good economic reports)....Anticipating that those who say the United States is going back into recession are wrong. That is what the stock market anticipated here in the month of October. Investors heard all the waling and crying and bashing the US economy that came from certain economists several weeks ago. They took it all in, they looked at the numbers and they said, you know something, these people look like they are simply wrong on the US economy when they say we're back into recession. That's the data said this week, and it said it loudly and clearly. With a 2 1/2 growth in the third quarter and with consumers continuing to show resilience in their spending patterns, the market spoke loudly and clearly this week, saying that those who are forecasting a return to recessionary times in the US are off base and tagged out."

Honey EC: This is the third time that Bob has bashed Economic Cycle Research

Institute’s Lakshman Achuthan (and others calling for a recession). Please read my article about it here.

GREECE AND THE EUROPEAN BANKING SYSTEM...Bob said: "The viability of the European banking system is at the heart of this whole issue. Now European countries must begin to move away from the welfare state syndrome that has been responsible for the collapse of the sovereign debt of Greece.....Most people would consider a 50% write-down a collapse....Now they need to grow their economies, to grow their way out of the mess that has been created."

Honey EC: If you want to read more of what Bob has said about Greece, please see my summary of his midnight appearance on Doug McIntire's Red Eye Radio here.

HONDA'S VEHICLE TO DIE FOR....Caller Bruce from Chicago asked for Bob's opinion about why we haven't gone forward with natural gas use. Bob said: "The president view is that he is sold, lock, stock, and barrel, for wind and solar.....The vehicles are out there. Honda has a natural gas vehicle to die for...It's already there. The infrastructure would follow if we could get the executive order out of the White House.....I don't know why George W. Bush did not further exploit the move to natural gas in transportation. I don't know of any reason why he should not have. I think he should have."

UNEMPLOYMENT RATE...Caller Susan from Illinois asked why unemployment in Illinois is at 10%. Bob said: "The national unemployment rate is 9.1, it certainly varies by local.....I think that the main reason companies are reluctant to hire is because they have enough employees to handle the demand that they currently have. And unless they see a pick up in demand that they believe will be sustainable, they are going to remain right where they are....The private sector has been growing at a decent rate.....We are losing government jobs at the federal, state and local level....Those lost jobs get subtracted from the total jobs number....Right now, a lot of the misery is being caused by lost government jobs.....The fiscal problems in Illinois are so severe that they have had to increase from 3% to 5% in the last year.....Consequently, you have to expect government jobs to go out the window in a place like Illinois with those kinds of fiscal problems."

EXCHANGE-TRADED FUNDS VERSUS MUTUAL FUNDS....Caller Martha from Berkeley asked Bob to explain the difference. Bob said: "They are very similar.....One of the differences is with an Exchange Traded Fund, you can trade during the day.....Only traders would care about this. Investors would not be tuned into this particular aspect....Mutual funds are priced at the end of the trading....So whether you're redeeming or purchasing you are going to do it at the net-asset-value at the close of the market. With an exchange-traded-fund, you can transact any time during the trading day."

VANGUARD ADMIRAL ACCOUNTS AND FIDELITY FUNDS...Bob said: "There are places like Vanguard where they have Admiral Accounts....You need a certain amount of money, not a tremendous amount at all because they've lowered it dramatically.....which means you get extremely low expense ratios. The lowest expense ratio I've seen across the board....I also think the Fidelity Fund Family, for example in their Fidelity Spartan Index Fund have some very competitive expense ratios."

CHARLES SCHWAB.... Honey EC: Schwab's Broad Market ETF expense ratio is 0.06%. Vanguard's VTI expense ratio is 0.07%. Bob never voluntarily mentions Schwab unless a caller asks him. He always mentions Vanguard and often mentions Fidelity. I have often wondered why the bias. When Bob was co-owner of the BJ Group, Schwab was the brokerage house they used. Then he sold the BJGroup. Did something happen? If so, why does he claim that "Chuck" is a friend? Later in the program, a caller specifically asked about Schwab. Bob said that "Chuck" was a "good guy" and that he had been a guest on the program. I do not remember Charles Schwab being on the program. If anyone does, please let me know.

Honey EC: I chuckled when I heard Bob say that he was "certainly

comfortable" with the caller having 20% of her portfolio in the Vanguard

international fund. That is precisely how much Bob has in his Marketimer model portfolios one and two. I

can't recall the last time that Bob even mentioned international

investing. Does anyone recall? But my-oh-my, what a coincidence. I wrote

an article about the subject just two days ago. It looks like the

international funds he recommends have greatly lagged the total stock market funds (see my article about international funds HERE for details).

GOLD AND SILVER BUYING....Caller Tom from Missouri asked Bob about investing in gold. Bob said that for years, he has recommended GLD for those who want a gold hedge. Bob is totally against buying numismatic coins.

Honey EC: It is true that Bob has been recommending GLD in Marketimer since May, 2009. However, he has never included gold in any of his model portfolios. It is an off-the-books

recommendation and he has given no guidance as to a buy-price or how

much one should own.

Before the silver market collapsed because of raised margin levels, Bob twice said on Moneytalk that silver could be used as a hedge in place of gold.

Before the silver market collapsed because of raised margin levels, Bob twice said on Moneytalk that silver could be used as a hedge in place of gold.

DON'T BUY INTERMEDIATE OR LONG-TERM BONDS....Caller Steve from Nebraska asked about Bob why a red flag is up on these bonds. Bob said that people are worried about rates "normalizing." If yields go up, both intermediate and long-term bonds will be underwater and anyone who buys them now is accepting risk.

FLAT TAX PROPOSAL....Bob said it is not going to happen because it would mean a tax cut for high earners and a tax increase for low earners. Bob went over all of the proposals by the Republican candidates including (his term): "The former boss at Godfather's Pizza." Bob summed it up: "To think the country is going to do that is beyond dreamland. I think about all you need to figure this out is an eight-grade diploma. This is not rocket science."

BOB'S FUNNY OF THE DAY....Bob said: "Let's go out to California, welcome to Moneytalk." A familiar voice replied: "Hi Bob, this is Andy."

Honey EC: I need to point out that Bob ALWAYS begins his calls

by introducing the caller by name and location -- always, always,

always. I conclude that this is one of Moneytalk's Frequent

Flyers, good old Andy from Redwood City, and Bob is aware that Andy is being discussed on this blog. LOL! Jeffchristie may know exactly

how many times Andy from Redwood City has gotten on the air -- that we

know of -- it's several times.

Bob's guest-speaker today was John Hofmeister, the president of Shell Oil Company. He wrote: "Why We Hate the Oil Companies: Straight Talk From an Oil Insider

And in this corner wearing in-the-red trunks, publisher of Marketholder, looking for a comeback after being defeated by both Cassandra and Bad News Bear in 2008 and terribly pummeled by Nevada Property, from Lake Las Vegas, Bob Brinker."

Pay per view, anyone?