February 13, 2012.....The S&P closed at 1351.77 today. That's an important level for investors who put money in the stock market when Bob Brinker issued a buy-signal in the 1300s. It means they are now back to even after a four year ride that cut the S&P almost in half from there (bottomed at 677).

When the S&P was at 1331.29 in February, 2008, Brinker sent a special subscriber bulletin. Excerpt: "We now rate the stock market attractive for purchase on any weakness that occurs in the current area of the S&P 500 Index low 1300's, or any minor weakness that occurs below that level."

Perhaps someday it will be possible for me to report that those who bought Brinker's mid-1400s buy-signal one month earlier are back to even. Marketimer, January 4, 2008 (S&P: 1468.36) Brinker said: "We continue to rate the market attractive for purchase on any weakness into the S&P 500 Index mid-1400's range."

Another Brinker forecast that did not happen: June, 2008 Marketimer, Bob Brinker wrote: "Our S&P 500 Index price target remains in the 1600 range either late this year or in 2009."

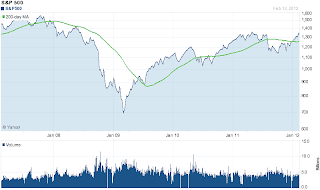

That's right folks, Brinker predicted new ALL-TIME-HIGHS in 2008 or 2009 (Unbelievably, Brinker also predicted the S&P would reach mid-1600s in the fall of 2007.) Look at the chart and notice what happened after Brinker issued these buy-signals and forecasts:

19 comments:

Honey your right Brinker is way off on his predictions. This is why his hours are being cut on the radio and also why stations have let him go.I dont think he is very credible and his only value now is an entertainment value like watching the horse races at the track. I think he will push his son in law on to the program as an analyst some time this year to recoup some listeners. What do you think? This is all showmanship and super sales stuff with the bottom line to sell the newsletter.. Thanks for your input and happy valentines day..

Ms Honey states:

Perhaps someday it will be possible for me to report that those who bought Brinker's mid-1400s buy-signal one month earlier are back to even

They will recoup faster than the poor souls that lost their retirements with the QQQ fiasco that he now hides.

A washed-up has been, and it's not even open to discussion anymore.

Now I give impy 20 minutes to show up and start whining about how NOONE bought the QQQ's and it was optional, and BLAH BLAH BLAH.....BLAH BLAH, ad nauseum

I dedicate this Happy Valentine's Day poem to each of you who read and participate in this blog. I appreciate you and I thank you for all of your kind emails and comments here.

Valentine Treasures

Valentine treasures are people who

have often crossed your mind,

family, friends and others, too,

who in your life have shined

the warmth of love or a spark of light

that makes you remember them;

no matter how long since you’ve actually met,

each one is a luminous gem,

who gleams and glows in your memory,

bringing special pleasures,

and that’s why this Valentine comes to you:

You’re one of those sparkling treasures!

By Joanna Fuchs

"They will recoup faster than the poor souls that lost their retirements with the QQQ fiasco"

Anybody who bet their retirements on a short term highly speculative trade deserves to lose it all.

It was a silly gamble from the start.

Tucson

Mr. Pig,

Good point. The last time that Bob Brinker told subscribers to hold those "Act Immediately" QQQ's for recovery was almost nine years ago.

This morning QQQ is still selling about 25% under the price he first recommended.

Dshort did an outstanding article on Bob Brinker's favorite love-to-hate economist, Lakshmann Achuthan co-founder of The Economic Cycle Reasearch Institute, ECRI.

ECRI's Puzzling Recession Call:

The Growth Index Contraction Eases Yet Again

"The credibility of the ECRI call has been undermined by a number of recent economic indicators, including today's better-than-expected decline in the unemployment rate. Likewise the unabated rally in major US indexes since the ECRI call casts additional doubt on their position."

But ECRI is now saying it will take up to a year to see if a recession arrives or not.

2012

Lakshman Achuthan: You Won't Know If Our Recession Call Was Wrong Until One Year From Now

Read more: http://articles.businessinsider.com/2011-12-08/markets/30489457_1_recession-q2-economy#ixzz1mNcLCoiN

2012

Good morning ladies and gentlemen. We have arrived at mid S&P 1300s. Current temperature is 55 degrees. We thank all of you who joined us on this round trip, hope you enjoyed your four year journey getting back to even, and we look forward to seeing you again.

For those of you continuing on with us to S&P 1400s we will be leaving shortly. Estimated date of arrival is unknown but like your fellow passengers who just left us, you too will one day also break even.

What's that, sir? Opportunity cost?

I'll let you speak to the pilot about that.

Thank you for flying Starship Moneytalk.

What's that, sir? Opportunity cost?

Oh this opportunity cost...

185 * 4 = $740

So you spent 740 dollars to have some schmuck do absolutely nothing for you. And Brinker complains about mutual fund fees - LOL!!!!

tfb

Once again Brinker was awarded a Hulbert award for beating the S&P over a 20 year period.

I have read enough posts here to know (to anticipate) that Ms Bee will say the figures are bogus. Brinker hides calls gone wrong and highlights special calls that go right, and he features and manipulates certain time periods that makes him look good.

But Hulbert seems to get on the Brinker Band Wagon at every opportunity. Do they have a "Band of Brothers" pact or is some other thing going on between them?

STINK BUG

Stink Bug said: "Once again Brinker was awarded a Hulbert award for beating the S&P over a 20 year period."

Stink bug,

Please explain what you are referring to...I just read the latest Hulbert Columns and the latest issue of Hulbert's Financial Digest, and I see no mention of Bob Brinker's 20 year record.

Bobbrinker.com/news and updates.

Bob Brinker's Marketimer Named to 2012 Honor Roll.

Maybe it isn't a big deal.

I also incorrectly said, beat S&P, it is the Wilshire 5000

Total that's compared over 20years.

Stink bug

Hulbert award

Hulbert is a bullshit, penny-ante two bit Huckster who would pimp his mother for a quarter like Brinker. He lost all credibility years ago when he research methodology was examined by some graduate students and only the ignorant would waste time with his fonts of disingenuousness. The folks who pay attention to Hulbert are the same types who use Morningstar’s star system to buy mutual funds.

His clap-trap B.S. cannot hold up to statistical scrutiny and he is the butt of jokes at ISU Mathematical Department(as are others, particularly some popular political pollsters).

You cannot believe a single thing that slime ball says any more than you can trust Bob(how can I fool them today)Brinker. The two are cut from the same cloth. Unlike HoneyBee I think any good Brinker ever did by promoting low cost mutual funds was undone by his perpetuating the fraud known as market timing.

tfb

Here is where it says Brinker beat the total market over the past 20 years.

"Hulbert Financial Digest named Bob Brinker's Marketimer © to its 2012 Honor Roll of Investment Letters. Marketimer © has earned an annual total return of 9.7% for the 20-year period through November 30, 2011. This compares with the Wilshire 5000 Total Stock Market Index annual total return of 8.5% for the same 20-year period."

http://www.bobbrinker.com/portfolio.asp

sr43

"Hulbert is a bullshit, penny-ante two bit Huckster who would pimp his mother for a quarter like Brinker. He lost all credibility years ago when he research methodology was examined by some graduate students and only the ignorant would waste time with his fonts of disingenuousness."

I can't find anything anywhere about anybody examining Hulbert's methodology. Is this one of those urban legends?

Maybe a link or two would help.

okrawell

Did the Wilshire 5000 charge 20 X $185?

Would you need to double that to 40 X $185 if you get the Fixed Income rag that invests in volatile stocks?

I'm sure you were going to bring this up. How about these 3 below?

BTW, how much did the Wilshire 5000 put into the QQQ counter-trend rally?

Do you know how many "all-in" calls the Wilshire 5000 made in the last 5 years?

Did the Wilshire 5000 buy TEFQX, and bury it?

No one should complain about losing their retirement on BB's QQQ missed call. His recommendation was to limit your purchase to 4% of your equity portfolio. If you were overweight in that trade that was your decision.

TimX,

What you said is patently FALSE! I'm going to assume that you have been mislead.

November 6, 2000 Marketimer:

"Marketimer subscribers with aggressive objectives can invest up to 30% to 50% of cash reserves in either the QQQ shares or Rydex OTC Fund in order to participate in this recommendations. That translates into potential exposure of 19.5% to 32.5% of a TOTAL AGGRESSIVE PORTFOLIO. (30% of 65% CASH RESERVES equals 19.5%. 50% of 65% cash reserves equals 32.4%). The balance of reserves remain in money market funds.

Conservative subscribers can invest up to 20% to 30% of cash reserves in this recommendation, using either QQQ shares or Rydex OTC Fund shares. That translates into potential exposure of 6.5% to 9.75% of a total BALANCE PORTFOLIO. (20% of 32.5% cash reserves equals 6.5%, 30% of 32.5% CASH RESERVES equals 9.75% of a BALANCED PORTFOLIO. The balance of reserves remain in money market funds."

I am copying your comments and my reply to the most recent article so it won't be missed. It is here.

Post a Comment